What does it take to qualify for Green Aids from the French Government in 2023?

Yes, in 2023. Because come next January, there will be a whole new package out there, which I will tell you all about when the time comes.

Own your Main Residence

The very first condition is that you direct the renovations to your main residence, and that the lodging was built more than 15 years ago. There do exist some aids for lodgings just over 2 years old, but they are scant, small, and only apply to lodgings you are planning to rent out.

Conditional on your Household Yearly Income

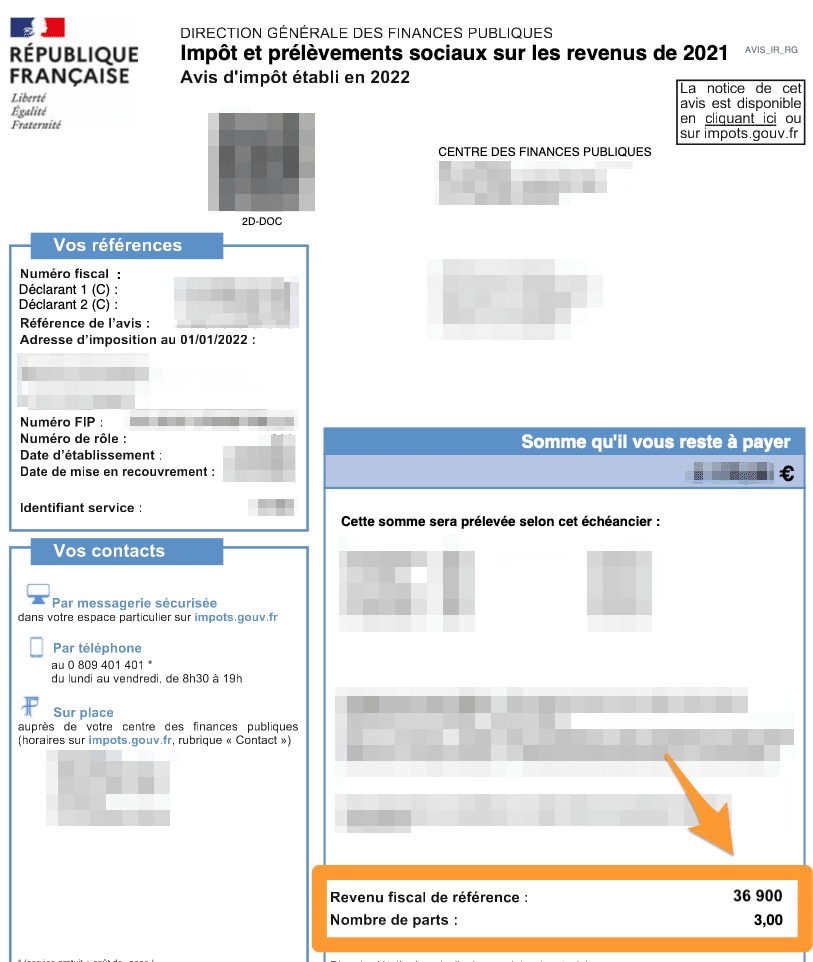

Below is where you will find your Household Yearly Income —or Revenu fiscal de référence in French.

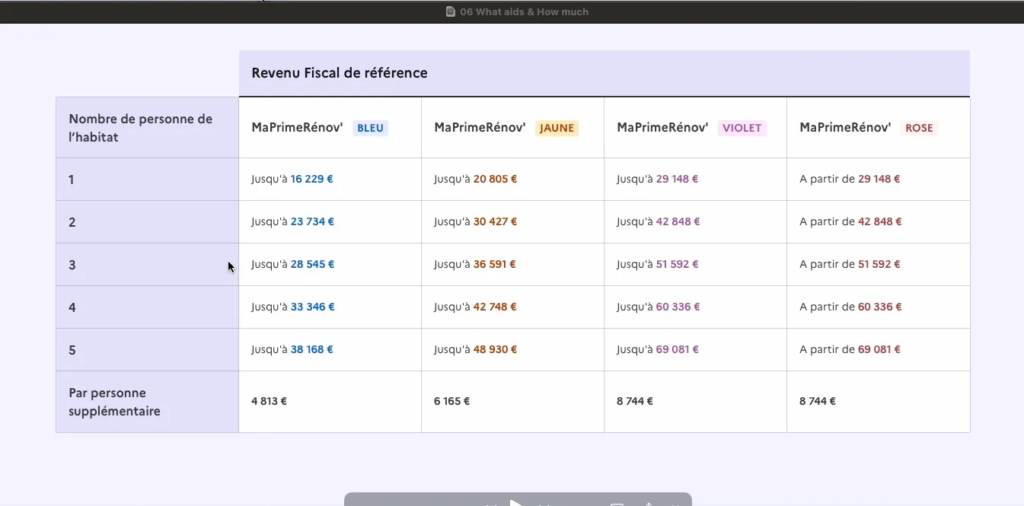

You will then be able to verify, from the table below, whether you have a chance at eligibility:

As you will observe, there’s a first column in which you’ll find the number of people in the household —from 1 to 5 and then you add a certain income with each extra person.

You then have another four colour-coded columns which will give you an idea of what income category you belong to, the blue category being the one with the lowest incomes, and the pink one the highest eligible incomes. Over €69.000, do not expect to qualify for any sort of PrimeRénov’.

And, There is still the VAT Reduction!

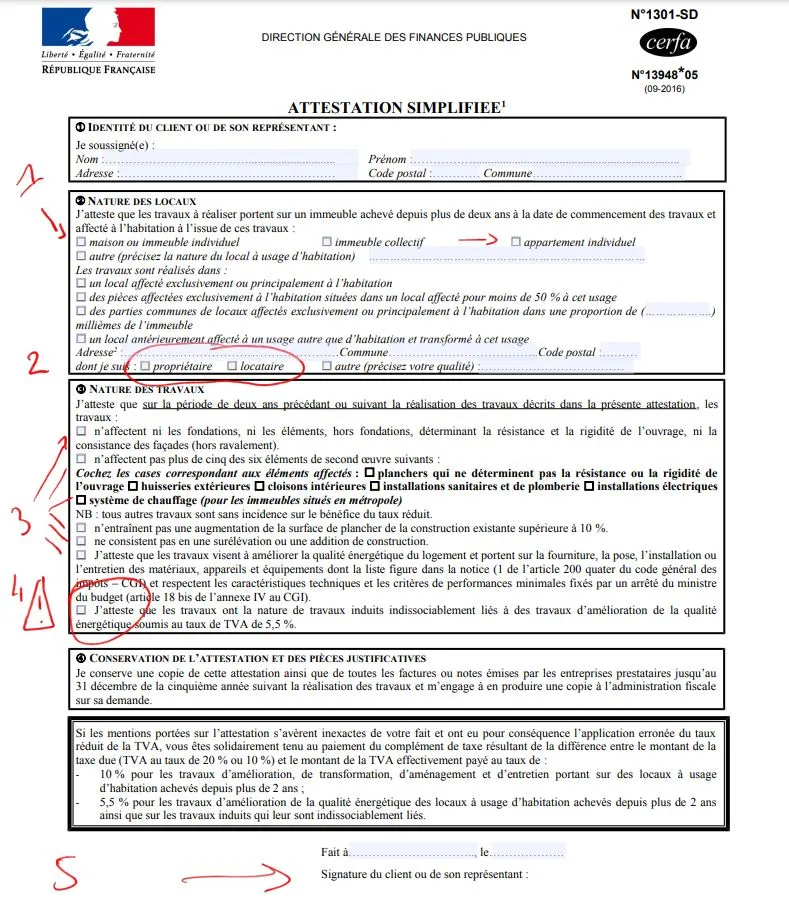

Indeed, no matter how high your income, if you go through an RGE professional for your renovation works, you can still benefit from a 5.5% VAT, instead of 10%, or even in some cases 20%.

You will also receive a specific form from your RGE professional, that you can use when declaring your 2023 income next year and thus see your tax reduced thanks to your green works on your house.

So, you see? There are ways to get some money saved when renovating our old homes.

And finally, there’s the Eco-PTZ —Éco-Prêt à Taux Zéro— which you can ask about at your bank.

But as mentioned earlier, there will be a whole new packaged-deal out in January next year! So, we’ll talk again.

Cheers!